No Shame. No Blame.

That’s the name of our game.

It’s never too late to rewrite your financial story.

Life's major milestones often come with significant financial shifts. While we may not always be comfortable seeking help, investing in expert guidance can be a game-changer. By proactively addressing your financial needs during times of transition, you're setting yourself up for long-term success.

Working with me means partnering with a dedicated financial expert. I am specifically trained and certified to help you make informed decisions that align with your goals. Unlike traditional advisors, I focus solely on your best interests, offering unbiased advice and personalized support.

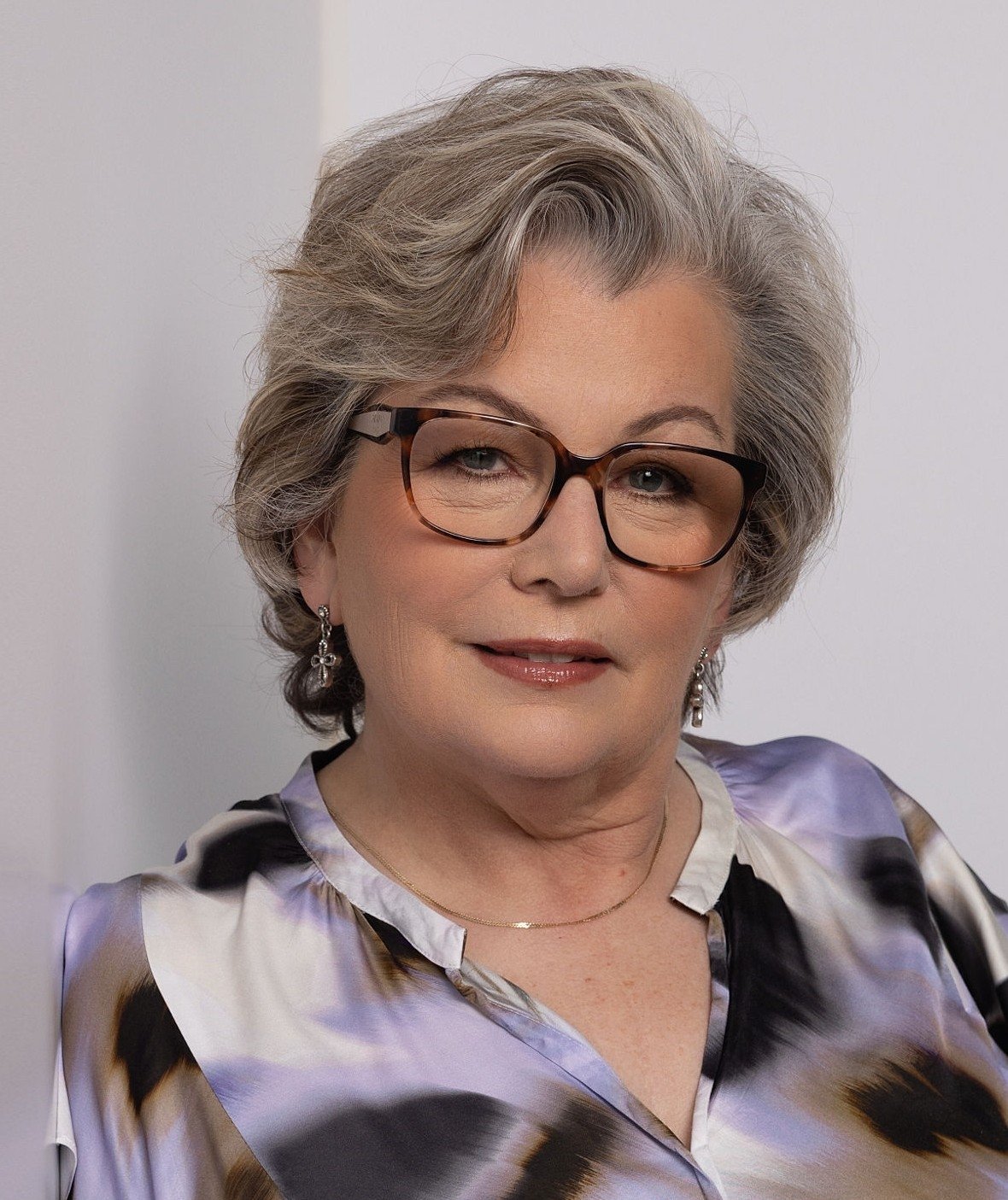

Carrie Gataiant, CFC™

Your Partner in Financial Resilience

Carrie Gataiant is an Independent Certified Financial Counsellor and passionate financial wellness coach, dedicated to empowering individuals to take charge of their financial journeys. With a wealth of experience in budgeting, debt management, and financial goal-setting, Carrie delivers personalized, actionable advice to help clients achieve lasting financial resilience and well-being.

Known for her compassionate and client-centred approach, Carrie has guided countless individuals through life transitions, helped them build healthier financial habits, and boosted their confidence in managing their futures. Her strategies are thoughtfully tailored to align with each client’s unique values and aspirations, creating a solid foundation for financial stability and fulfillment.

“I wanted the freedom to serve my clients on my own terms.”

Carrie’s expertise has been shaped by her mentorship under one of Canada’s top financial wellness leaders, Lesley-Anne Scorgie, owner of MeVest. As one of the select few chosen for private 1:1 coaching sessions, Carrie collaborated on innovative solutions and strategies designed to deliver the best outcomes for her clients. This exclusive experience underscores her commitment to excellence and her ability to craft transformative financial strategies.

Client Journeys

How We Work Together

I understand how heavy financial stress can feel. Money struggles often carry worry, shame, and sleepless nights—and it can feel isolating when you don’t know where to turn. You are not broken, and you are not alone.

At the heart of my work is deep compassion and respect for your lived experience. Money is rarely just about numbers—it’s shaped by emotions, past experiences, family patterns, and survival strategies. True financial well-being comes from understanding your money story, rebuilding trust in yourself, and creating habits that support what truly matters to you.

We move at your pace. Side by side, we work to reduce financial stress, strengthen confident decision-making, and create a realistic financial plan that fits your real life—not an idealized version of it. This is not about perfection; it’s about clarity, confidence, and a growing sense of calm and steadiness around your money, now and into the future.

I bring both professional expertise and lived experience to this work. For years, I struggled with finances myself—budgets that felt suffocating, investments that didn’t seem to move, and the quiet fear of never getting ahead. It wasn’t until I took an honest look at my money and reached out for support that everything began to change. I found my way out of debt, built momentum, and began to see meaningful growth—and that journey shapes how I support you today.

Thrive, Not Just Survive

Ready for a fresh start?

Let’s hit the reset together!

Boosting Financial Smarts

You will walk away with a solid foundation in financial literacy, mastering key concepts and practical skills to handle money matters confidently. Whether it’s decoding budgets or navigating debt repayment, you’ll be ready to apply this newfound knowledge to everyday life.

Achieving Financial Stability

As you implement what you’ve learned, you’ll start seeing real improvements in your financial well-being. Expect to hear success stories of growing savings accounts, shrinking debts, and a more secure financial future that feels within reach.

Healthy Money Habits for the Win

Say goodbye to old habits and hello to smart financial behaviours! You will embrace healthier approaches to managing income, expenses, and debt. From sticking to a spending plan to building an emergency fund, these habits are game-changers (for extra tips & tricks to save money, check out our Resources & Freebies!)

Goodbye, Financial Stress

Taking control of your finances isn’t just about numbers—it’s about peace of mind. With a clear plan in place and less uncertainty, you’ll enjoy lower levels of stress and anxiety. Managing money becomes less of a headache and more of a source of empowerment!

“Whether it’s breaking down what’s really in your investment portfolio or helping you set up a budget that actually works, I’m here to make sure that you never feel lost or intimated again.”